Holistic Financial Planning

Cash Flow Management

- Retirement withdrawl strategy

- Emergency fund

- Cash management

- Financing options and analysis

- Caring for aging parents

- Education expenses and planning

Protect Your Wealth

- Determine life, disability, health, and long-term care insurance needs

- Review current policies

- Make recommendations for any uncovered needs or adjustments

- Coordination with a professional insurance agent

Investments

- ongoing discretionary management of your investable assets, through accounts held in custody at Charles Schwab

- passive and fee-conscious investing approach that ensures your portfolio will remain diversified, low cost

- portfolio that matches risk tolerance, time horizon, and goals

- use a combination of exchange traded funds (“ETFs”) that track major stock and bond indices and individual U.S. Treasury securities

Retirement

- Determine retirement lifestyle goals and possible scenarios

- Social security planning

- Determine retirement spend needs

- Evaluate and advise on current employer retirement plan

- Advise on early retirement or downshifting

Tax Planning

- Tax efficient investing

- Tax efficient distributions plan

- Tax reduction strategies

- Guidance on tax law changes

- Income tax planning

- Small business tax analysis and planning

- Coordination with CPA

Estate Planning

- Review beneficiaries and titling on assets

- Review estate plan or refer to an attorney to create an estate plan

- Review POAs

- Ensure trusts are funded appropriately

- Plan future gifts

- Coordinate with estate attorney

Ongoing Planning and Services

Pre-retirees (within 3-5 years of retiring)

- Single

- $4500/yr

- Couples

- $5250/yr

Retirees (within 2 years of retiring through retirement)

- Single

- $8,500/yr

- Couple

- $9,000/yr

(Billed monthly in advance)

*Pricing is for typical client scenarios. More complex scenarios will receive a custom proposal.

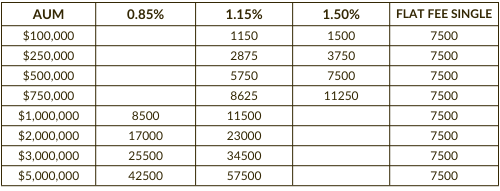

How does this flat fee compare to AUM fees?

The table below gives some examples of fees calculated by a percentage of AUM

(assets under management). Calculation methods vary from firm to firm.